How risky is it not to invest?

For those who are investing, why do you invest? And for those who don’t, what’s stopping you?

Personally, the initial reason was to grow my money and have passive income. To me, passive income means near auto-pilot mode that I do not need to spend too much time supervising it once everything are in place.

It is only after a while that I realized the main aim was to beat inflation.

“Beat inflation?“, you might ask.

Inflation – Does it really matter?

Just think about this:

How much had that can of coke or transport fare increased in the last 5 years?

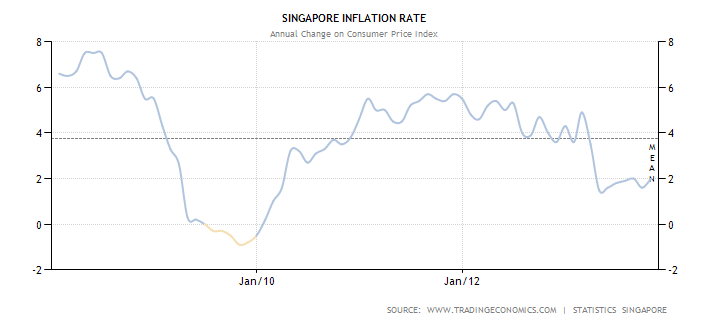

(Source: http://www.tradingeconomics.com/singapore/inflation-cpi)

The average inflation rate for the past few years was 3.65%. It simply means that the prices of the products you are purchasing have increased 3.65% annually.

So if you had $100 kept securely in a bank savings account with annual interest rate of 0.05%. You will be dismayed that you are not able to buy as many cans of coke now compared to five years ago.

The tables below will help illustrate the growth of the product prices and your savings.

| Original | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|

| Coke | $1.00 | $1.04 | $1.07 | $1.11 | $1.15 | $1.20 |

| Savings (0.05%) | $100.00 | $100.05 | $100.10 | $100.15 | $100.20 | $100.25 |

| No. of cans you can buy | 100 | 95 | 93 | 89 | 86 | 83 |

Well, you might argue that the money can be parked into fixed deposits as they have better “returns”. Lets choose one that gives you 1.10% annual interest rate for a 12-month lock-in period.

| Original | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|

| Coke | $1.00 | $1.04 | $1.07 | $1.11 | $1.15 | $1.20 |

| Fixed Deposits (1.1%) | $100 | $101.10 | $102.21 | $103.36 | $104.47 | $105.62 |

| No. of cans you can buy | 100 | 97 | 95 | 92 | 90 | 88 |

It seems like it is not better either. You still cannot buy the same amount of coke by keeping it in fixed deposits instead of savings accounts. Mind you, rolls of money in biscuit tins are the worst! It is the same $100 five years ago.

So? To invest or not to invest?

Well, it is really up to you. There are no guarantees in investing or trading. There are always wins and losses. I am not advocating you to dump all your life savings into investments, or rather, put your cash into several buckets – emergency funds, investment, entertainment, etc.

Give it a thought and read more (on the Internet) before starting your first baby step in investment. Have a safe journey.