December 2014 Stock Portfolio Update

| No. | Stock | Units | Average Price | % of Portfolio |

|---|---|---|---|---|

| 1 | Sembcorp Industries Ltd | 1000 | 5.051 | 8.85% |

| 2 | Nikko AM STI ETF100 | 1274 | 3.261 | 8.67% |

| 3 | Singapore Press Holdings Limited | 1000 | 4.001 | 8.33% |

| 4 | SIA Engineering Company Limited | 1000 | 4.671 | 8.19% |

| 5 | StarHub Ltd. | 1000 | 4.101 | 8.19% |

| 6 | Frasers Centrepoint Trust | 2000 | 1.806 | 7.6% |

| 7 | M1 Ltd | 1000 | 3.331 | 7.12% |

| 8 | ABF SG BOND ETF | 3000 | 1.137 | 6.95% |

| 9 | Sheng Siong Group Ltd | 5000 | 0.594 | 6.83% |

| 10 | Cache Logistics Trust | 3000 | 1.167 | 6.83% |

| 11 | ST Engineering Ltd. | 1000 | 3.781 | 6.75% |

| 12 | SPH REIT | 3000 | 0.901 | 6.17% |

| 13 | Sats Ltd | 1000 | 3.041 | 5.88% |

| 14 | Sabana REIT | 2000 | 1.085 | 3.64% |

| 2014 Performance (Singapore Dollars) | |

|---|---|

| Total dividends collected | $1,739.50 |

| Total Invested Capital | $50,498.26 |

| Projected Annual Yield | $2,037.22 |

| Average Monthly Dividends | $144.96 |

| Unrealised Gains / Loss | $34.30 |

Nothing much was done this month despite the Oil and Gas sector being hit hard. Instead of investing in new counters or averaging down existing counters, I decided to just add Nikko AM STI ETF100 (SGX:G3B).

On the dividends side, I will be collecting $190 worth of dividends from:

- Sats Ltd (SGX:S58) – $50.00

- Singapore Press Holdings (SGX:T39) – $140.00

Looking Back & Moving Forward

This month also marks the full calendar year of investing for 2014. Started off with invested capital of $38,365.86 in January 2014 and it has increased to $50,498.26 now. It works out to be an average of $1,000 investment monthly. I wonder if I can (still) keep this up once the new member join us in January 2015. Yes, we have got a baby joining us in January 2015. 😀

For the entire year, I have collected $1,739.50 worth of dividends. This works out to be 3.44% annual yield or $144.95 monthly dividends. Majority have been reinvested while the rest had ended up as good food.

For 2015, I shall be more discipline in doing fundamental analysis and add new counters to the portfolio! Let’s target an average of $250 monthly dividends next year. 🙂

Buying Bullion

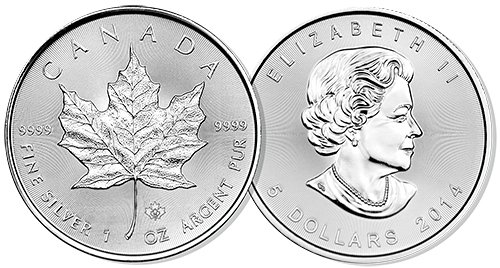

I took a liking for silver recently and decided to buy a couple of Canadian Maple Leaf 1oz silver coins. In fact, I bought a tube of 25 coins and later bought a single 1oz in airtite coin capsule.

Do I take buying bullion as an investment? Probably yes.

Although bullion does not generate cashflow like the dividend counters or REITs but the spot price of silver has dropped to around US$15 from the US$50 from about 4 years ago. So the chances of achieving capital gains are really good. It has in fact stayed at this level for a while and it should move (up or down) soon.

However, if you are really interested in the capital gains instead of the designs, you would probably want to get the bars over the coins ounce-for-ounce as the premiums for the former are lower.

Lastly, I bought the coins at a shop in Beauty World Centre and the buying experience was good. Most importantly, the prices are attractive too so drop me a note if you want the seller’s contacts.