Evaluating GoldSilver Central Savings Accumulation Program

GoldSilver Central (GSC) recently launched the GSC Savings Accumulation Program for physical gold, silver and platinum in Singapore. It allows retail investors to accumulate physical precious metal on a daily basis for a flexible period of time (i.e. S$5 daily for 3 months). After the accumulation period, investors have the option of taking physical delivery of their holdings. The prices are based on GSC 10am reference price. Details of the news report can be found here. A copy of GSC Savings Accumulation Program brochure can be found here.

Essentially, the GSC Savings Accumulation Program is doing dollar cost averaging over a period of time. They have two accumulation options:

- Fixed Investment Amount. Intended investment sum over a time period. For example, S$100 monthly for 3 months. Basically, it will accumulate the amount of precious metal that the S$100 can net you in a month (or essentially what S$5 can get you in a day assuming 20 working days in a month).

- Target Ounces to Achieve. The amount of precious metal (i.e. Gold, Silver, Platinum) to accumulate over a time period. For example, to accumulate 1 ounce of gold at the end of 3 months. Basically, it will try to accumulate 10 grams of gold per month (or 0.5 gram per day assuming 20 working days in a month) based on the price of gold at the point of purchase.

Is GSC Savings Accumulation Program Better?

This accumulation program got me thinking whether accumulating precious metal via the accumulation program is more worthwhile (or cheaper) than purchasing a block off the retail shops (i.e. GoldSilver Central, SK Bullion).

So I decided to do a simulation based on the two accumulation method to understand what is the percentage/ chance that I might get a block of gold cheaper off the retail shop than accumulating gold via this program for the same time period. Essentially, if I am targeting to get 1 ounce of gold after 3 months (i.e. from start of Oct 2016 to end of Dec 2016), what is the chance that I will get a ounce of gold cheaper off the retail shop during the same period?

Simulation of GSC Savings Accumulation Program versus Purchase off Retail

Data Set

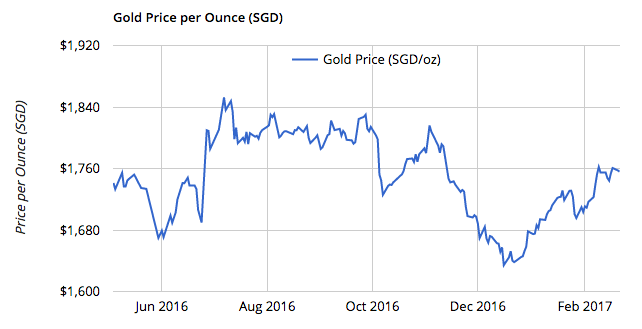

I pulled off the GSC 10am reference price from 4 May 2016 to 21 February 2017. There are only 194 records as there are days with no price data or they are simply non trading days. The earliest available record is 4 May 2016.

The price of gold for the period is as follow:

Costs

I dug into the brochure and Terms and Conditions and found the following associated costs:

- Daily storage fee of 2.5% per annum for every precious metal saved/ accumulated

- Premium top up of S$55 per ounce of gold

Assumptions

- The daily storage fee is also charged for weekends

- The premium S$55 per ounce of gold is the same as the amount of premium over gold’s spot rate when getting off retail store

- 1 troy ounce equals to 31.10 grams

- The same GSC 10am price applies to retail purchase on the day

- Daily rested storage fee based on the accumulated gold on the day

- No gold is accumulated on missing data and non trading days

- For those missing data and non trading days, the gaps are filled using previous trading day’s storage fee for the accumulated gold weight

Findings – Fixed Investment Amount versus Purchase off Retail

This is pretty straight forward and the follow parameters were set:

- $10 per day for the 194 trading days

The amount of gold (in grams) purchased daily using $10 is:

By 21 February 2017, the results are as follow:

| Key | Value |

|---|---|

| Accumulated Gold | 34.47455054 grams |

| Invested Cost | S$1,940.00 |

| Storage Fee | S$19.70568067 |

| Total Cost (Invested + Storage Fee) | S$1,959.705681 |

With these details, how often will getting the same amount of gold off the retail shop be cheaper?

| Key | Value |

|---|---|

| Number of days that retail shop is more expensive | 84 |

| Number of days that retail shop is cheaper or equal | 110 |

Findings – Target Ounce to Achieve versus Purchase off Retail

The following parameters were set:

- A total of 1 ounce (31.1 grams) of gold to be accumulated during the period from 4 May 2016 to 21 February 2017

- The weight is evenly accumulated over the 194 days with data points (0.1603092784 gram per trading day)

The amount spent per day to purchase 0.1603092784 gram of gold is:

By 21 February 2017, the results are as follow:

| Key | Value |

|---|---|

| Accumulated Gold | 31.1 grams |

| Invested Cost | S$1,751.78436 |

| Storage Fee | S$17.90294372 |

| Total Cost (Invested + Storage Fee) | S$1,769.687304 |

With these details, how often will getting the same amount of gold off the retail shop be cheaper?

| Key | Value |

|---|---|

| Number of days that retail shop is more expensive | 82 |

| Number of days that retail shop is cheaper or equal | 112 |

Summary of Findings

Based on the period of simulation (4 May 2016 to 21 February 2017), one will be able to purchase gold off retail shop at a cheaper (or equal) price approximately 57% of the time.

It also seem to suggest that there is no cost benefit in adopting the GoldSilver Central Savings Accumulation Program. However, the program does ensure one accumulate precious metal regularly.