May 2017 Stock Portfolio Update

| No. | Stock | Units | Average Price | % of Portfolio |

|---|---|---|---|---|

| 1 | ABF SG BOND ETF | 11966 | 1.154 | 18.43% |

| 2 | SPDR STI EFT | 2200 | 2.989 | 9.58% |

| 3 | Nikko AM STI ETF100 | 1967 | 3.221 | 8.7% |

| 4 | Sats Ltd | 1000 | 3.041 | 6.82% |

| 5 | Sheng Siong Group Ltd | 5000 | 0.594 | 6.5% |

| 6 | Sembcorp Industries Ltd | 1500 | 4.675 | 6.33% |

| 7 | Frasers Centrepoint Trust | 2000 | 1.806 | 5.6% |

| 8 | SIA Engineering Company Limited | 1000 | 4.671 | 5.2% |

| 9 | ST Engineering Ltd. | 1000 | 3.781 | 4.92% |

| 10 | Singapore Press Holdings Limited | 1000 | 4.001 | 4.23% |

| 11 | SPH REIT | 3000 | 0.901 | 3.96% |

| 12 | Singapore Post Limited | 2200 | 1.338 | 3.65% |

| 13 | StarHub Ltd. | 1000 | 4.101 | 3.62% |

| 14 | Cache Logistics Trust | 3000 | 1.167 | 3.5% |

| 15 | Parkway Life REIT | 1000 | 2.34 | 3.48% |

| 16 | M1 Ltd | 1000 | 3.331 | 3.01% |

| 17 | Sabana REIT | 2000 | 1.085 | 1.13% |

| 18 | iShares Core MSCI World UCITS ETF | 14 | 43.759 | 0.9% |

| 19 | Vanguard FTSE All-World ETF | 4 | 72.178 | 0.41% |

| 2017 Performance (Singapore Dollars) | |

|---|---|

| Total dividends collected (Current year) | $969.16 |

| Total dividends collected to date (Nov 2013 – Now) | $7,209.61 |

| Total Invested Capital | $78,146.53 |

| Projected Annual Yield | $2,508.76 |

| Average Monthly Dividends | $80.76 |

| Unrealised Gains / Loss | -$2,557.24 |

Through POSB InvestSaver, bought 88 units of Nikko AM STI ETF (SGX:G3B) at $3.3542 and 429 units of ABF SG Bond ETF (SGX:A35) at $1.158.

Dividends

Received S$344.80 worth of dividends:

- StarHub Ltd. (SGX:CC3) – $50.00

- ST Engineering Ltd. (SGX:S63) – $100.00

- Sembcorp Industries Ltd (SGX:U96) – $60.00

- SPH REIT (SGX:SK6U) – $42.00

- Singapore Press Holdings Limited (SGX:T39) – $60.00

- Parkway Life REIT (SGX:C2PU) – $32.80

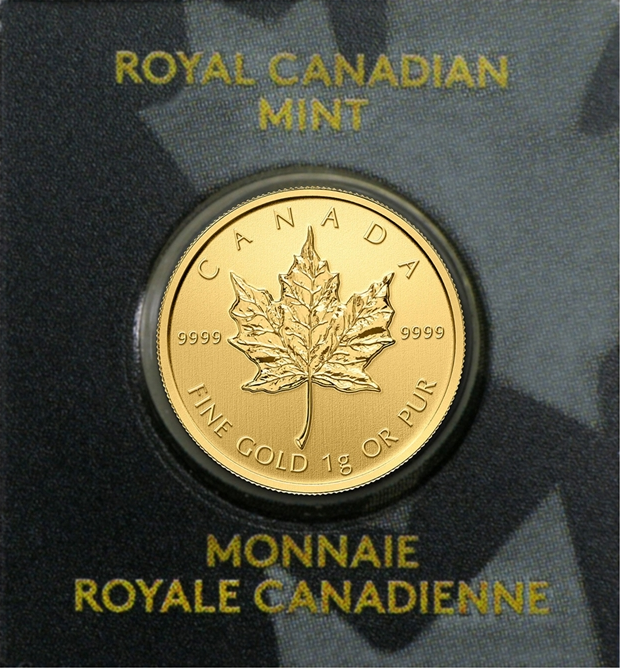

Precious Metal – Gold

Discovered that SK Bullion has online presence on Lazada. The best part is that Lazada coupon codes can be used to offset the purchases.

I ended up purchasing 10 of the Royal Canadian Mint’s 1g MapleGram25g. The 10 gm of 99.99% gold costed me S$543.75 which averages out to be S$54.38 for 1 gm of gold when the spot rate is S$56.92 for 1 gm of gold.