July 2017 Stock Portfolio Update

| No. | Stock | Units | Average Price | % of Portfolio |

|---|---|---|---|---|

| 1 | ABF SG BOND ETF | 12820 | 1.155 | 19.31% |

| 2 | SPDR STI EFT | 2200 | 2.989 | 9.51% |

| 3 | Nikko AM STI ETF100 | 2143 | 3.235 | 9.37% |

| 4 | Sats Ltd | 1000 | 3.041 | 6.51% |

| 5 | Sheng Siong Group Ltd | 5000 | 0.594 | 6.41% |

| 6 | Sembcorp Industries Ltd | 1500 | 4.675 | 6.29% |

| 7 | Frasers Centrepoint Trust | 2000 | 1.806 | 5.49% |

| 8 | SIA Engineering Company Limited | 1000 | 4.671 | 5.22% |

| 9 | ST Engineering Ltd. | 1000 | 3.781 | 4.83% |

| 10 | Singapore Post Limited | 2200 | 1.338 | 3.84% |

| 11 | SPH REIT | 3000 | 0.901 | 3.84% |

| 12 | Singapore Press Holdings Limited | 1000 | 4.001 | 3.79% |

| 13 | Cache Logistics Trust | 3000 | 1.167 | 3.65% |

| 14 | StarHub Ltd. | 1000 | 4.101 | 3.52% |

| 15 | Parkway Life REIT | 1000 | 2.34 | 3.46% |

| 16 | M1 Ltd | 1000 | 3.331 | 2.45% |

| 17 | Sabana REIT | 2000 | 1.085 | 1.19% |

| 18 | iShares Core MSCI World UCITS ETF | 14 | 43.759 | 0.91% |

| 19 | Vanguard FTSE All-World ETF | 4 | 72.178 | 0.41% |

| 2017 Performance (Singapore Dollars) | |

|---|---|

| Total dividends collected (Current year) | $1,281.53 |

| Total dividends collected to date (Nov 2013 – Now) | $7,521.98 |

| Total Invested Capital | $79,726.14 |

| Projected Annual Yield | $2,543.63 |

| Average Monthly Dividends | $106.79 |

| Unrealised Gains / Loss | -$2,244.39 |

Through POSB InvestSaver, bought 88 units of Nikko AM STI ETF (SGX:G3B) at $3.3823 and 427 units of ABF SG Bond ETF (SGX:A35) at $1.1643.

Slowly inching towards having 20% of my portfolio in SG Bonds ETF.

Dividends

Received S$47.47 worth of dividends:

- Nikko AM STI ETF (SGX:G3B) – $47.47

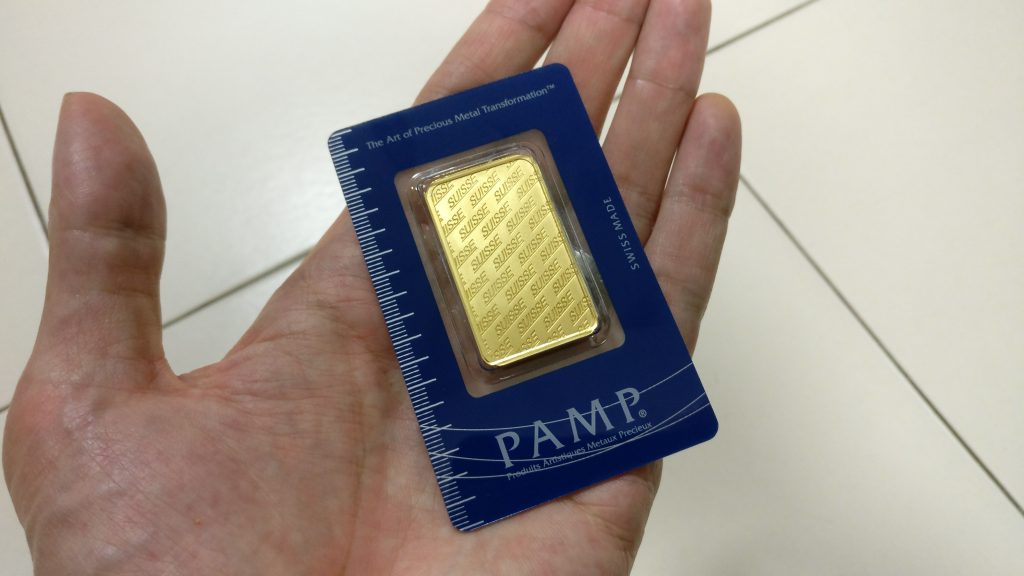

Precious Metals

Both gold and silver dipped slightly in the week of 10th July 2017 and I promptly went down to SK Bullion to pick up the following:

- Pamp Suisse 1oz Gold at S$1,710.00 (~S$54.98/gm)

- 25 pieces of Canadian Maple Leaf 1oz Silver coins for S$579.75 (~S$0.77/gm)

- 2017 Australian Lunar Rooster 10oz Silver coin at S$250.89 (~S$0.81/gm)

These are to commemorate the upcoming arrival of my second child. Hope these are still worth when they are all grown up.