Applying for SGS Bond using SRS Fund

Little did I expect that applying for Singapore Government Securities (SGS) bond issues using funds from Supplementary Retirement Scheme (SRS) account is a lengthy process filled with question marks and confused looks from bank staffs. In fact, it is just involves filling up a two-page form but it took me almost two hours at DBS Bedok branch. I reached there at 4.10pm, was attended to at 4.30pm and only left the place at 5.45pm on a Thursday.

This doesn’t fall under the investment services (of DBS). Instead, it is considered account opening. What? Yes, I didn’t expect that application for book-entry government securities is considered to be an account opening service.

To save others from the painstaking process that I went through in order to place a non-competitive bid for SGS bond(s) issue using funds from SRS account, I am going to document down the details that you will need to provide and the forms that the bank is supposed to dig out from their internal repository (or hidden drawer). Yes, the forms are not online nor is the process documented on DBS website.

If you are funding the SGS bonds purchase using cash, you can simply do it via I banking and this entry is not for you. However, if you are funding using SRS account, you will need to pay your SRS custodian bank a visit (in person).

Basically, the stuffs that you need to bring down to your SRS custodian bank are:

- Your NRIC;

- Your CDP account number (the 12-digit CDP securities account number);

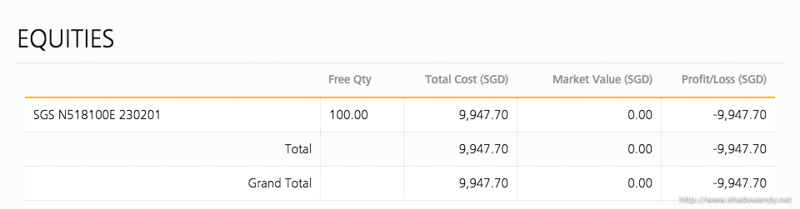

- Details on the Issue Code (e.g. N518100E) and its Issue Date (e.g. 01 February 2018); and

- Details on the investment amount (e.g. $10,000).

The SRS custodian bank will need to provide the following:

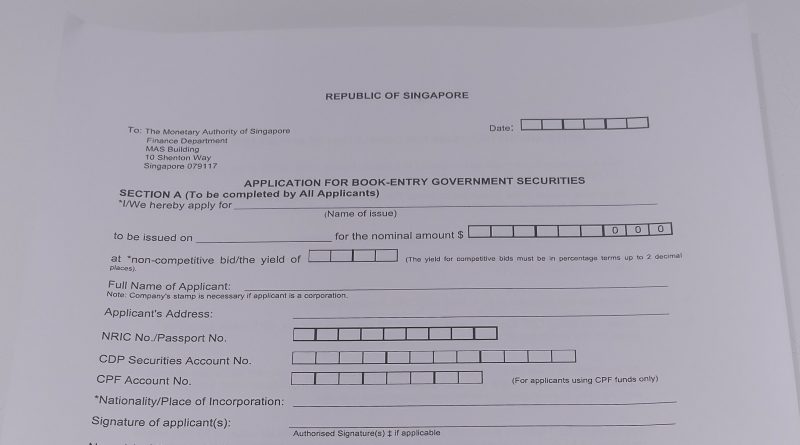

- The form titled “Application for Book-entry Government Securities”; and

- Courier services to their HQ for the completed form.

For non-dealers like us, we will make a non-competitive bid for the bond issue. What it simply means is that we will accept whatever coupon rate the bond issue ends up with.

Those sections pertaining to cash account settlement number should be filled by your custodian bank.

After the form is filled up, you will need to provide the necessary signature (or thumbprint) for the relevant accounts.

What’s left after that is to sit back and relax. Check your bank account and CDP statements a few days after the auction closes to see if you are successful.

One very important thing to note is that the deadline for manual application is a few days before the bond issue’s closing date for application. In N518100E’s case, the closing date for application is 12 noon of 29th January 2018 while DBS’s closing date is 26th January 2018. If you miss it, you can look out for the next bond issue.

Lastly, don’t underestimate the queue or waiting time for DBS’s account opening service. For the record, I SMS-ed for a queue number while I was at Plaza Singapura. Took a train to Bedok and walked over to the DBS branch and I still had to wait for my turn.

Hope your purchase or application of Singapore Government Securities (SGS) bonds using SRS account funds will be a much smoother experience than mine.